A 457(b) plan is usually supplied to point out and local government and community company staff members. They are often considered a supplemental way to save for retirement.

Start a discussion We are going to fulfill you where you are in your monetary journey and make it easier to reach in which you should be.

A brokerage account is used for standard preserving and investing. It can be utilized by any one for several different objectives. Consequently, it's a quite common account used for retirement.

Searching for more Strategies and insights? We'll supply them suitable for your inbox. Take care of subscriptions

Just because other investments haven't got tax Positive aspects doesn't suggest they must automatically be dominated out. Passive profits is one of these. During retirement, they're able to are available kinds including rental money, cash flow from a business, inventory dividends, or royalties.

There are a variety of doable SERP designs. Most often, These are built possibly as defined profit or defined contribution plans. An outlined gain SERP delivers a benefit in the form of an annuity at retirement. When included to the employee’s projected cash flow with the competent retirement plan and Social Security Added benefits, the annuity will equivalent a specified share of the employee’s ultimate regular compensation, much like a conventional defined gain pension plan.

Investigating normal lifetime expectancy is a superb place to get started on. The Social Protection Administration’s existence expectancy calculator can provide you with a stable estimate, based on your date of birth and gender.

Retirement planning is a multi-action approach that evolves after a while. It starts off with contemplating your retirement ambitions and how much time you have to meet them. Then you must choose and lead to retirement accounts that can assist you raise the money to fund your long term.

We're not able to complete your ask for presently as a consequence of a process mistake. Remember to here try again soon after a couple of minutes.

Your price savings can likely increase tax-deferred till you withdraw resources in retirement. At the time of withdrawal, you shell out everyday money taxes within the pre-tax contributions and development.

Try to ramp up your personal savings. This is a hectic time of everyday living for Many individuals, but It is also a time when your earnings could be going up.

Previously, she led taxes and retirement protection at NerdWallet. She is a author and editor for more than twenty years.

By clicking “Acknowledge All Cookies”, you comply with the storing of cookies with your device to reinforce site navigation, review web site usage, and assist within our internet marketing attempts.

Examine far more automobile financial loan resourcesBest auto loans forever and undesirable creditBest auto loans refinance loansBest lease buyout financial loans

Josh Saviano Then & Now!

Josh Saviano Then & Now! Brandy Then & Now!

Brandy Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Susan Dey Then & Now!

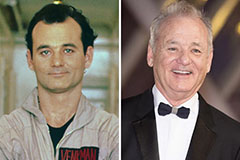

Susan Dey Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!